The value of owning a big, beautiful home is underappreciated. Somewhere along the way, society began favoring minimalism and smaller living spaces, often dismissing larger homes as “McMansions.” But after spending five weeks living in a much smaller space again, I’ve gained a renewed appreciation for the comfort, privacy, and functionality that a larger home provides.

One of the unexpected “downsides” of going on a family vacation is realizing how hard it is to match the comfort of your own home. I think this rings true for most families.

You might live in an 1,800-square-foot, three-bedroom, two-bathroom house with your family of four. But on vacation, you often end up squeezing into a hotel room or a one-bedroom suite with a sofa bed. Vacation lodging has gotten so expensive! Renting a place that matches the size and quality of your own home is simply out of reach for many.

After 26 nights at my parents’ place and nine nights at my aunt and uncle’s ~1,000-square-foot, two-bedroom, two-bathroom home, I can say with certainty: I truly love owning and living in a bigger home. And, I’m not afraid to admit it!

Definition Of A Big Home

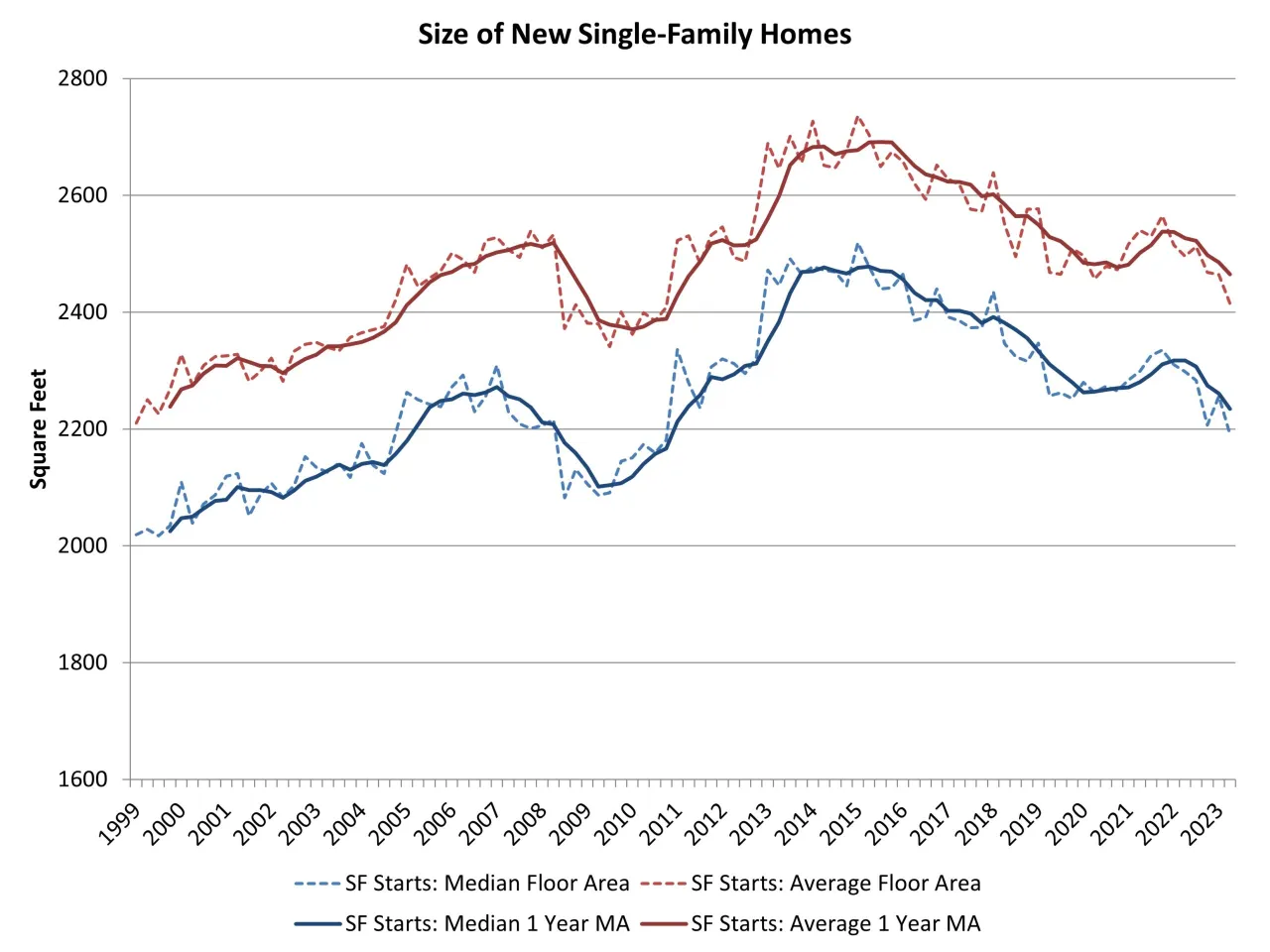

In 1981, the median size of a newly purchased home was about 1,700 square feet. By 1993, that number had grown to 2,000 square feet. This size increase was driven by the rise of suburban living and the growing demand for more space and modern amenities for families.

Throughout the 2000s, the average home size hovered between 1,920 and 1,940 square feet. When the first-time homebuyer tax credit was introduced to stimulate demand, the median size temporarily dipped to around 1,850 square feet before climbing back to 2,000 square feet between 2010 and 2015.

By the early 2020s, home sizes surged again, reaching between 2,200 and 2,300 square feet. According to the U.S. Census Bureau, the median size of a completed single-family home in 2023 was 2,233 square feet. Today, the average home size remains around 2,200 square feet.

Now that we know the median home size in America, we can better define what qualifies as a “big” home. In my view, a big home is one that’s at least 50% larger than the median—meaning it has at least 3,100 square feet of living space. You can localize the number using the figures based on where you live too.

A Big Home Over a Small One—Especially With Kids

A small home (50% smaller than median or more) is perfectly fine if you don’t have kids. I shared a studio with my high school friend and lived in a one-bedroom condo with my wife for years. But once you have kids, you’ll want as large of a home—and lot—as you can comfortably afford. Otherwise, you might go crazy.

One night at my aunt and uncle’s house on the North Shore of Oahu really drove this point home. It was a particularly windy night. I slept on a twin-size sofa bed in the living room, while my wife slept with our daughter and our son had his own room.

At 12:30 a.m., our daughter screamed out in her sleep, waking us up. Then at 1:30 a.m., a plastic cup flew off the kitchen counter. At 2 a.m., a mysterious thunk! Our son had fallen out of his bed (I didn’t realize it until later). Then another scream at 2:30 a.m. And finally, just before dawn, something flew off my wife and daughter’s bedside table, waking all three of us.

Getting woken up five times in one night will drive anyone a little nuts. I was dragging all day on the Fourth of July. If we had a larger home, we might have only woken up once or twice.

And the last time I slept on a sofa bed was in college in 1998. But with my son sleeping like a tornado, sharing a queen bed would’ve meant zero rest for both of us given I snore.

More Space, More Happiness

If possible, aim to buy a home with at least one bedroom per person. And if each bedroom can have its own en suite bathroom, even better. This setup dramatically improves everyone’s ability to sleep soundly and function well the next day.

With a big home, sound insulation and space make a huge difference. Comfort levels rise, and sleep improves, something every parent can appreciate.

Young kids are energetic. They need space to run, play, yell, and explore. If you’re considering a smaller house, at least prioritize a large, usable lot.

What I appreciate about my aunt and uncle’s place is that their house only takes up about 12% of the lot size so it was great for the kids.

The Ideal Lot Size For A Big Home

Ideally, look for a property where the lot size is at least twice the size of the home’s square footage. For example, if you buy a 3,500-square-foot home, aim for at least a 7,000-square-foot lot. Of course, in big cities where land trades at enormous premiums, this ratio may hard to find at a reasonable price. But we’re talking ideal here.

Try not to let the house take up more than 75% of the lot. Even with a large house, a lack of outdoor space can make things feel cramped. Sunshine and fresh air are essential for your well-being—especially if you have little monkeys running around.

Here’s a big, beautiful house I’d enjoy living in.

A Big Home Is Better for Work From Home

One of the hardest parts about sleeping on a sofa bed in a 1,000-square-foot, two-bedroom, two-bathroom home with three other people is the hit to my productivity. As a writer, I need peace and quiet—something that’s nearly impossible to find in a compact home on one floor with two young kids.

My AirPods became my best friend, but even they couldn’t block out all the noise. As a result, I had to wake up by 3:30 a.m. just to get some writing done before my son wakes up—sometimes as early as 5 a.m., and always by 6.

If I were a single guy in my 20s or 30s, sharing a place like this with a two or three roommates for several years wouldn’t be a big deal. After all, I shared a studio for two years with a friend. But as a 48-year-old writer who’s paid his dues, I’d much rather live in a larger home on two levels.

When I’m in a flow state, I want to write uninterrupted. A small home constantly pulls me out of that zone.

Downsize Later, If You Want

Living in a modest 1,000-square-foot home gave all of us perspective and appreciation. More importantly, it taught my kids to adapt to a smaller living arrange and show respect for their grandparents’ home.

In San Francisco, I’ve been fortunate. After renting a 600 square-foot one-bedroom condo with my wife, I finally took a leap of faith and bought a 990-square-foot 2/2 condo in 2003. In 2005, I upgraded to a 2,070-square-foot single-family home with three bedrooms, two bathrooms, and a bonus room. Then I downsized in 2014 before buying larger homes again in 2019, 2020, and 2023.

Going from big to much smaller is like going camping—you give up creature comforts and appreciate what you have even more when you return. One of my biggest concerns with climbing the property ladder was giving my kids a warped sense of reality. That’s why trips like these are helpful resets.

If your first car is a brand-new BMW instead of an old beater, you might end up forever spoiled. That’s not great for building appreciation. That’s part of why I drove for Uber for a year and gave over 500 rides. Working a near-minimum-wage service job was humbling, but it grounded me and made me more grateful.

If you feel bad about living in a big, beautiful home. Don’t be. you can always downsize later, or after the kids move out. Just don’t downsize too small, otherwise, your kids may never come back to visit!

Yes, Big Homes Are More Costly To Maintain

A key principle of achieving financial independence is keeping your living expenses as low as possible. One way to do this is by getting neutral real estate and paying off your mortgage as quickly as you can. Another is by buying or renting the cheapest place you can tolerate for as long as possible.

I’m a big proponent of saving aggressively on housing costs so you can invest more in the stock market and other risk assets to build wealth faster. Big homes have higher utility bills, higher maintenance expenses, higher property taxes, and more things that can break or go wrong. An expensive home can derail your FIRE plans, for sure!

That said, if you’ve got a family and want to YOLO more, a bigger home can significantly improve your quality of life. More space often means better sleep, fewer arguments, and a more peaceful household.

It’s not just about luxury—it’s about functionality and family harmony. Many people came to this realization during the pandemic, when cramped living quarters became all too real.

So if you’re in a position to do so, enjoy your big, beautiful home. Just don’t forget the value of living simply and the lessons that come from making do with less.

Readers, do you own a big, beautiful home? If so, how large is it, and how does it compare to the median home size in your city? In your opinion, at what point does a home become too big? What do you consider a “big” home, and what are some downsides of owning one—beyond the higher carrying costs?

Surgically Invest In Real Estate

If you’re looking to invest in real estate without the headaches of dealing with tenants or maintenance, check out Fundrise—a private real estate investment platform with nearly $3 billion in assets under management.

Fundrise focuses primarily on industrial and residential commercial properties in the Sunbelt region, where valuations tend to be lower and yields higher. With mortgage rates gradually declining, valuations still soft from the Fed’s aggressive rate hikes, and a continued structural undersupply, commercial real estate looks increasingly attractive.

I’ve personally invested over $430,000 with Fundrise, and they’ve been a longtime sponsor of Financial Samurai.

Subscribe To Financial Samurai

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Your shares, ratings, and reviews are appreciated.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise.